In today’s world of ever-growing options, brokers and their employer groups want to curate the best health care solutions for their member population and present them in a way that’s accessible. They also want to enforce greater transparency across their health plans, contain health care costs, and promote better clinical outcomes. And, in the wake of the COVID-19 pandemic, it’s more important than ever to make sure that employees stay informed of recent changes to their health care benefits.

Key to doing all of this is creating a cohesive member experience. A well-designed benefits experience can empower members to access the best-quality care without creating additional work for themselves or HR professionals. Communicating with members effectively makes them more likely to access preventative care and address health issues early on, before they escalate.

Here’s a closer look at 5 factors that HealthComp focuses on to provide an engaging member experience:

Best-in-Class Technology

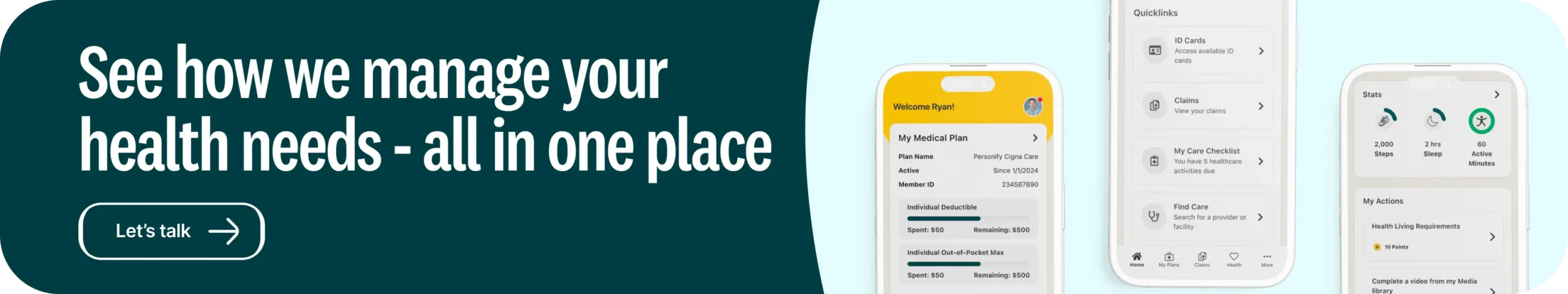

A benefits platform should be more than just a repository for medical claims. It should bring together the resources that members need to understand their health coverage, find the right care provider, and access programs that can improve their quality of life. How this information is presented is also important. A platform that is thoughtfully designed and user-friendly will take away much of the frustration that is often associated with navigating health care.

HealthComp’s HCOnline member platform brings together the resources that our members need to use their benefits wisely. We use clear visuals and simple language so members can understand their benefits and access the best-quality, in-network care. The platform includes a “Your Benefits” page, which gives members direct access to their point solutions. And because we use proprietary technology that’s maintained by an in-house team, we are always looking for new, innovative ways to add to our member experience.

Omni-Channel Customer Service

With today’s multi-generational workforce, it helps to provide multiple channels for customer support (e.g. phone, online chat, etc.), so members can choose the mode of communication they like best. Members who contact customer service should be connected with benefits professionals who are familiar with their health plan and can answer their questions quickly and accurately.

At HealthComp, members can reach our Benefits Assistants via phone or live chat. When a member contacts our customer service line, they’re connected with a Benefits Assistant who is fully trained in their plan. For issues involving providers, we’ll even make outbound calls to the provider in question so the member doesn’t have to. Our priority is to resolve issues as quickly and painlessly as possible.

Open Communication

With many employees working remotely due to the COVID-19 pandemic, it’s important to be intentional and even excessive in keeping them educated about their benefits, health, and safety. By communicating openly, employers can keep plan members informed of recent changes to their health plan and encourage them to use telemedicine solutions instead of going to the doctor’s office. Open communication can also promote benefits literacy and improve employees’ engagement with their benefits.

A good communications strategy must take into account the diversity of today’s workforce. Being able to communicate in different formats (e.g. phone vs. online) and styles (e.g. detailed vs. bite-sized) is key.

HealthComp’s members stay informed during every step of the benefits process. We’ve designed our communications to be eye-catching and easy-to-understand, and we also work with employer groups to develop custom communications that are tailored to the needs of their workforce. For example, communications may be provided in multiple languages and mediums – such as flyers, emails, and videos. They can also incorporate an employer’s corporate branding.

Industry-Leading Care Management

Care management programs have become a vital part of helping employers ensure quality while reducing their healthcare spend. These programs are especially important as more employer groups take a value-based approach to benefits. And with the advent of new technologies such as artificial intelligence and predictive analytics, care management programs have become even more impactful in reducing costs.

To meet these needs, HealthComp has an in-house, fully integrated care management (CM) practice. Today, our CM staff includes 80 associates, including 45 nurses. We offer a full suite of CM programs, all of which leverage clinical data to target high-cost or problem areas. Because our CM team is located in-house, they can work closely with other departments to provide a higher level of care to our members.

A Wealth of Knowledge

In health benefits administration, experience and expertise matter. Brokers want to partner with an administrator that has worked with employer groups of all different types and sizes. The administrator should be operationally sound and have experience in customizing health plans to meet an employer’s requirements. They should also have a unique member experience that supports better clinical outcomes for plan members and reduced costs for employers.

At HealthComp, we’ve been achieving these results longer than any other independent benefits administrator. Our company was founded in 1983. Our average employee tenure is eight years, and our average tenure for supervisors is 12 years. But this doesn’t mean that we’re satisfied with the status quo. What it does mean is that we have a team of seasoned professionals who bring an unmatched level of expertise and passion to what we do.